Our funding mix: foundation for stable growth

AKA secures all funding needs for its lending business – even in difficult market phases – and takes additional strength through its special shareholder structure and its business model. AKA’s shareholder banks in particular have been an important source of funding since its establishment in 1952.

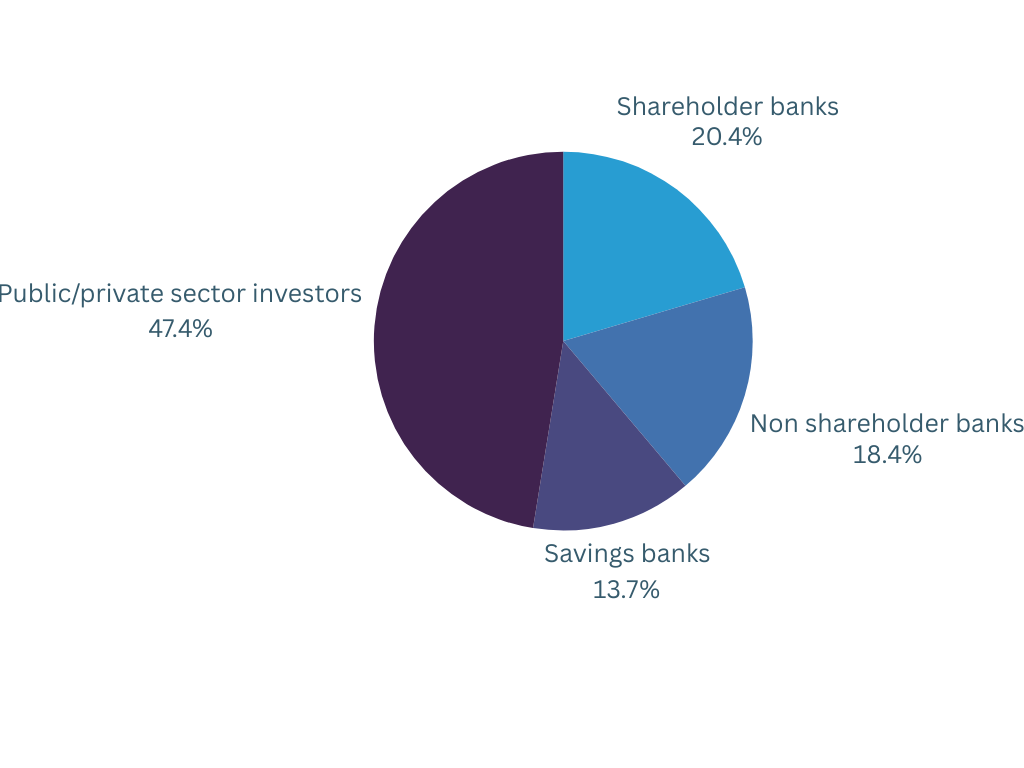

Over the last few years, AKA has steadily acquired additional public and private-sector banks as well as investors outside its shareholder structure. The bank takes funds from these investors in the form of term deposits and Schuldschein. AKA executes these transactions in euros (EUR) and US dollars (USD).

AKA is a strong partner with a broad base.

Principles of refinancing

- AKA is a non-trading-book bank and its treasury activities solely finance its own lending business.

- AKA offers solidity by means of matching maturities, currencies and fixed interest periods.

- Investors are strategic partners. AKA attaches high importance to its long term relationship-based approach.

AKA as a money market participant

In 2023, the refinancing partners jointly concluded short-term trading transactions in the amount of approx. EUR & USD 500 million. AKA is basically on the borrowing side here.

Typical EUR transactions have maturities of 6 to 12 months, USD borrowings are mainly concluded for 3 to 6 months.

Secured capital market

In accordance with AKA’s business model, most of its lending business is funded by assigning the ECA cover. Basic principle has always been the refinancing by the shareholder banks’ and public programmes.

Since 2016, AKA has been taking a new approach in this area. We are gaining more and more international investors as partners. They now provide a significant share of all long-term ECA-covered refinancing, which was increased by more than 22 % during 2022. In the course of the Europeanisation strategy, the AKA Treasury team is continuously working on further partnerships.

AKA establishes itself on the capital market

Since the start of capital market activities in 2016, a total of more than EUR 900 million has been raised. This development shows the strong confidence of investors in AKA. AKA has been able to steadily establish new business relationships, particularly in the areas of insurance companies, health and pension funds, bank treasuries and local authorities.

Unsecured capital market: Long-term security based on strong partnerships

The shareholder banks are also an important element in our funding basis for unsecured credit facilities. However, strategic growth in the area of Structured Finance requires increasingly more funding for non-ECA-covered transactions.

- Spring to summer 2016: preparation for capital market activities

- September 2016: announcement that AKA plans to raise long-term funding of around EUR 100 million in the coming year in the maturity between three to seven years with a special focus on four to six years

- November 2016: issuance of a Schuldschein for AKA for the first time since 2011

- December 2016: first floating-rate Schuldschein issued

- May 2017: goal achieved: funding of EUR 100 million raised in the maturity range of three to six years

- December 2017: term deposit for ten years transacted; this means that the entire maturity curve up to ten years is covered. AKA closed a 10 year transaction and could build up a yield curve of 3-10 years, all within a one year period

- December 2019: already raised more than EUR 380 million uncovered long term funding

- August 2020: Capital market borrowings reach more than half a billion EUR

- December 2022: raised a volume of EUR 870 million with 48 partners

Potential for new investors

AKA is on a steady growth track in the money market sector as well as in the capital market. In this connection, investors – both new and existing, who have been working with AKA for many years – are important strategic partners.

Based on this partnership, we can achieve stability and long-term growth.

A partnership approach is important for us in this respect. It depends on transparency and on-going sharing of information.