Investor Relations – achieving solid growth together

As a European export and trade bank, AKA is active in more than 70 countries around the world. It is a reliable partner to its customers in its role as a specialised institution for export finance – expanding steadily and solidly.

AKA continues to operate in its segment in close cooperation with you. For this reason, we keep you posted here on all the latest developments.

Key documents for investors

AKA Sustainability Mission Statement

Sustainable action is a central component of our values and we are committed to creating long-term values for customers, investors and society and aligning them with environmental and social aspects.

The central premise of our transformation activities is the incorporation of the United Nations' 17 Sustainable Development Goals (SDGs) and the implementation of the requirements of the European Green Deal and the Paris Agreement.

We are aware of the fundamental impact of our financial decisions and are applying a holistic approach to driving forward the transformation of the economy. We strive to align our business activities with global initiatives, support the sustainable transformation of our customers, offer innovative products and solutions and also contribute to climate and environmental protection and social equity with our own projects. Our financing activities in developing and emerging countries support living conditions at regional, national, European and global level in which prosperity is distributed as fairly as possible, ecosystems are preserved and social equity is promoted

AKA Annual Report 2023

Strong business performance in times of war, crisis and transformation: In 2023, AKA has once again found ways to look to the future together with shareholders, partners, exporters, importers and credit insurers and to make its own impact. Diplomatic skill, strategic foresight and cooperation based on trust are indispensable tools for overcoming the impassibilities. Thanks to the resilience of the AKA business model, solid financial figures were achieved.

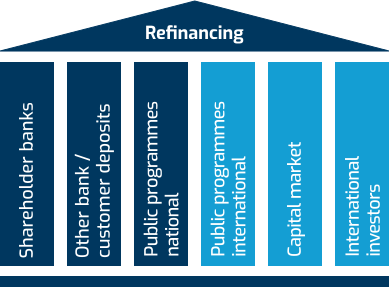

Funding sources

AKA is a member of the deposit guarantee fund.

Are you interested in finding out about ways of working together?

Here you can find out more about our funding mix.