Export finance in the tug-of-war between tradition and transformation

Global trade in the midst of change

Guest contribution by Dr. Markus Ampenberger, Managing Director and Partner, Boston Consulting Group and Dr. Erich Suess, Managing Director and Partner, Boston Consulting Group

Global trade is in a period of profound change after many years of multilateralism, free trade without restrictions on imports and exports, and the use of global supply chains. A period of relative political stability after the end of the Cold War is giving way to geopolitical conflict, economic nationalism and protectionism, and national security policy interests. These tectonic shifts are slowing the growth of global trade. While overall growth remains positive, it will be more moderate in the future and more focused on regional markets.

New patterns in trade streams

As a result of the changing geopolitical situation, companies are reconfiguring their supply chains and trade routes with the goal of reducing dependencies on a few suppliers and/or the supply of key raw materials or (preliminary) products from geopolitically unstable regions. For example, the new US government is expected to try to reduce dependence on imports and sway global businesses to relocate manufacturing sites to the US as part of its economic policy involving the declaration of tariffs.

This trend will impact certain industries particularly strongly, including the automotive sector (exporters from the EU) and the electronics industry (exporters from Asia). At the same time, it is expected that China will be increasingly aligned with the Global South1 while India and Southeast Asia are gaining in importance as growth engines of global trade. Europe is also facing a realignment: The aim is to significantly increase productivity and expand the focus on China to date through increased domestic trade in the EU and partnerships with the US, Japan, and emerging markets, such as India, Turkey, and Africa

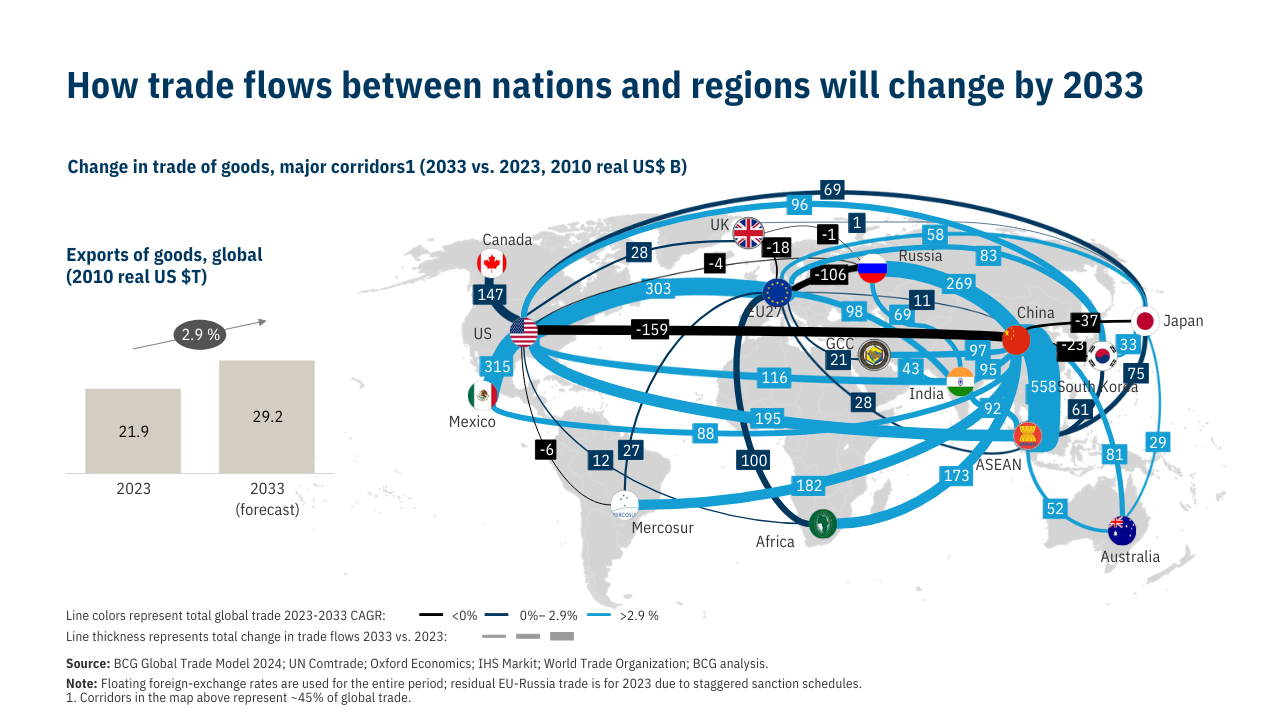

The figure shows currently anticipated changes in global trade flows over the next decade based on the BCG Global Trade Model2. Due to the fragile geopolitical situation, however, depending on the development of industrial and customs policy, higher uncertainty and volatility with respect to trade volume and its regional distribution can also be expected in the coming years.

In this uncertain environment, a geostrategic view with forward-looking scenario planning is becoming essential for international companies so that they can anticipate geopolitical developments early on and flexibly adapt supply chain and trading strategies to the given situation.

Technology as a driver of change

Digital innovation is transforming the way the global export economy is handled. AI-powered data collection was a first step, but end-to-end digitisation requires structured data formats and API-based networks. Regulatory gaps, fragmented standards, and isolated platforms still hinder progress. At the same time, new technologies such as generative AI have significant potential – from automated data extraction to document review and contract management. Many applications are still in the pilot phase, but companies that invest in them early gain clear competitive advantages in the increasingly digitised world of commerce.

Europe in line with global trends

The increasing regionalisation and strategic reconfiguration of supply chains are also clearly visible in Europe and Germany. One example is the replacement of Russian energy imports with supplies from Norway or strategic partners like the United States. Further momentum for the export economy arises from the increased Basel III capital requirements and expanded compliance regulations; the implementation of new free trade agreements, such as Mercosur; and the Green Deal and ESG regulations.

Germany’s export economy between continuity and adaptation

The German export economy is facing a structural change in its sales markets, while its industrial concentration is expected to remain unchanged. Based on a trade surplus of around EUR 300 billion and a share of about 10 % of the worldwide trade of goods in 2023, Germany will remain a leading export nation in the next few years. EU countries continue to be its most important trading partners, both as a sales market and as collaborators in course-setting for trade policy. At the same time, due to the geopolitical situation, greater diversification of sales markets is to be expected, for example, through an expansion of trade relationships with countries in the Global South. Despite market changes, the export economy is expected to remain focused on its established core industries: The engineering, automotive, chemical, and pharmaceutical industries will continue to form the mainstay of German foreign trade.

Export and Trade Finance under pressure

The export loan business in Germany has not moved in line with the general development of foreign trade in recent years. For example, while exports increased overall, the new coverage volume of export credit guarantees in the German market declined noticeably. At the same time, there are significant differences in the use of these hedging instruments within the EU. While some Member States rely heavily on export credit guarantees, their importance remains limited in other markets. These differences require targeted, country-specific strategies for banks and specialty financiers like AKA so that they can secure their ECA-covered financing over the long term and develop customised, competitive solutions for exporters.

Strategic course-setting for AKA’s future

To maintain its key role for German and European exporters, even in an environment with increasing regionalisation, technological disruptions, and regulatory challenges, AKA must continue to develop its strategic orientation. Three key diversification levers are the focus:

Geographic diversification

Germany remains the central market, but it would be sensible to expand the business focus to other European countries with growth in the ECA business. Targeted expansion of AKA’s network and broader positioning within Europe can greatly help AKA remain competitive in the long term as a specialised financier.

Sectoral diversification

Increased engagement in growth industries, particularly in the area of green transformation with high financing volumes involving German companies as suppliers or partners in consortia for the expansion of sustainable infrastructure, renewable energy such as geothermal energy and wind/solar energy, and technological innovations, is crucial. Here, AKA can position itself as a specialist partner of the German lending industry through the targeted expansion of industry expertise to effectively support the export economy in these key future sectors.

Product portfolio expansion

Beyond the classic ECA protection, it makes sense for AKA to further develop its finance offer to stimulate future growth. The targeted development of expertise in the areas of leveraged finance and the syndicated loan business (for example, for the export-oriented German mid-market) would enable AKA to cooperate with its shareholder banks in other business areas as well and to expand its product portfolio. With the measures outlined here, AKA can actively help shape trade finance in the tug-of-war between tradition and transformation and permanently strengthen its position as a specialist financier and key partner of the German lending industry.