Powerful partnerships. International success.

AKA is a specialised bank for international trade and export finance. We widen the financial options available to our partners by offering a range of fast, dependable solutions – and a powerful network of banks. Our services include everything from ECA-covered loans to structured trade and acquisition finance. For more than 70 years, we have stood for expertise, partnership and long-term growth.

Experienced and dependable

With over 70 years of experience, we are a dependable partner in the area of export and trade finance. Naturally also including new fields such as acquisition finance. Our expertise in complex finance structures enables us to create stability where it is needed.

Efficient and fast

We are a specialised financial institution with clear-cut processes and shortened lines of communication. For you, this means quick decisions, open communication and trouble-free processing. For no-fuss, international finance.

Flexible and individual

We support your entire credit life cycle – from the pitch phase right through to the secondary market. Thanks to our flexibility, we can structure each transaction individually and precisely – for importers, countries and banks.

Global business. Worldwide loans.

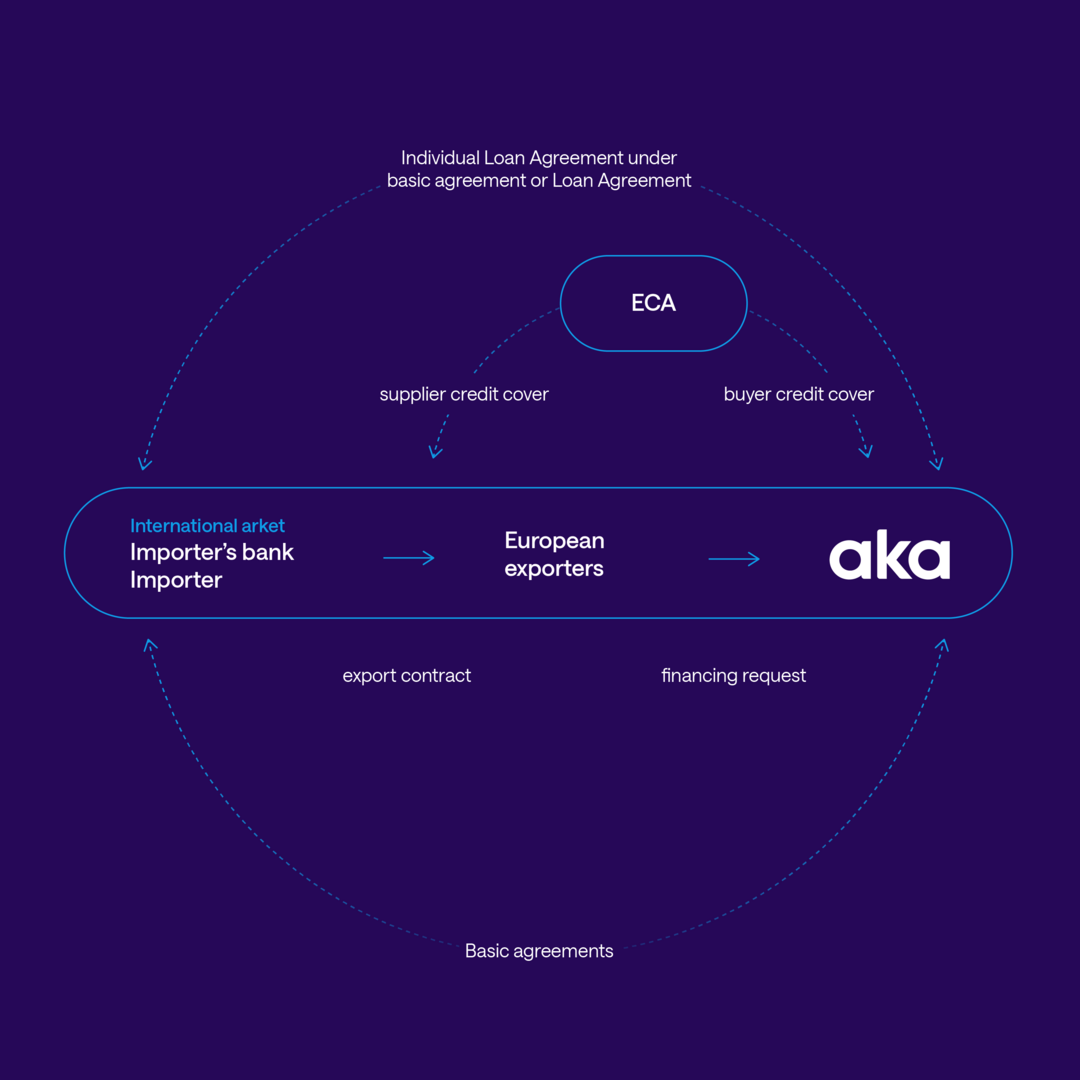

ECA-covered loans allow export goods to be financed securely and attractively worldwide – to the benefit of all concerned, including exporters, banks and importers. The buyer benefits from medium to long-term finance, and the exporter from immediate liquidity – secured by official Export Credit Agency (ECA).

We therefore offer international importers, banks and sovereigns dependable and long-term finance solutions for exports from Europe. Our expertise in ECA-covered loans and personal advice will help you realise your international projects securely and efficiently.

Our products

Buyer Credit

For international buyers, AKA's ECA-covered buyer loan represents a reliable finance solution for export transactions from Europe. Thanks to the protection provided by an Export Credit Agency (ECA), long-term financing can also be realised on a secure and calculable basis – thus providing protection against political and economic risks. This is how AKA creates trust, stability and flexibility in international trade – dependably, efficiently and collaboratively.

Small Ticket Buyer Credit

With our small ticket buyer credits, exporters from Germany, Austria, Switzerland and other selected EU countries (e.g. Belgium and the Netherlands) can apply for order values between EUR/USD 1 million and EUR/USD 15 million directly via our online portal SmaTiX (Small Ticket Express). The exporter receives immediate payment on cash terms, while the importer benefits from medium- to long-term financing – often more attractive and with longer tenors than those available locally. This keeps their local credit lines free for other purposes. With SmaTiX as a one-stop shop, we handle the entire process – from the credit application through to disbursement.

Structured & Project Finance

Major international projects require stable and flexible finance solutions. We support investments in infrastructure and in the power, plant engineering and process industries with project loans based on the project company's cash flow. Our loans combine ECA-covered tranches with accompanying uncovered tranches. The loans are customised to meet complex requirements, and create reliable foundations for projects with European sourcing.

Pre-Payment Finance

Pre-payment finance relieves buyers of the burden of providing the 15% advance payment prescribed by the OECD Consensus as part of an ECA-covered buyer loan. If required, AKA can co-finance this pre-payment as a commercial tranche – and thus reduce the buyer's equity requirement. AKA supports borrowers and creates stability and security for the successful realisation of international projects by providing pre-delivery payment finance in addition to an ECA-covered buyer loan.

Bridge Finance

Our bridge loans secure liquidity in the transition phase until the long-term ECA-covered export finance is disbursed. This allows projects to be started without delay and implemented on a dependable basis. They are founded on flexible, customised structures that are tailored to suit individual maturity periods and markets. These ensure the customers ability to act and provide continuity in international project finance.

- Over 70 years of expertise in export finance

- More than 8,000 ECA applications

- Unrivalled knowledge of the target markets

- Network of 17 national and international commercial and regional banks

- Global proficiency in ECA-covered financial solutions

- Variable and fixed interest rates (CIRR loans)

- Euler Hermes and OeKB Shopping Line

- Agent roles: Documentation Agent, Facility Agent, ECA Agent, CIRR Agent

- Environmental & Social Advisory

- Small Ticket buyer credits

- Large-volume and complex transactions

- Extensive expertise and knowledge of the market

- Shortened lines of communication, rapid decisions

- Customised long-term finance solutions

The European market. A powerful network.

We work closely with selected European Export Credit Agencies (ECAs). Together with our partner banks, we participate in ECA-covered finance – or can assume this role in full. This is always based on official, state-backed cover –- in Germany, for example, through Euler Hermes.

Catalysing financial requirements. Securing commodities.

We accompany structured solutions along the entire value chain. We provide finance solutions to commodity producers, suppliers and traders – bilaterally or in a syndicate, in a silent or active arrangement.

Our product portfolio includes everything from asset-based finance to working capital lines and receivables solutions. This creates dependable structures for international trade and commodity transactions, particularly in the emerging markets.

In addition, we accompany or arrange and syndicate unsecured (plain vanilla) loans for banks, multilateral institutions and sovereigns.

Our products

We participate in syndicated trade loans for banks and corporates, bilaterally or as part of international syndicates. Our involvement is silent or active, covered or uncovered, in the primary and secondary markets, but with a focus on the EMEA region.

Together with multilateral partners such as the EBRD or IFC, we benefit from our preferred creditor status and are effective at hedging risks. We also support the financing of regional development banks in emerging markets.

In future, we will also take a leading role in arranging transactions for EMEA borrowers – from origination to distribution, together with experienced syndicate banks.

Via our FI desk, we participate in bank risks on a silent basis, by providing letters of credit (L/Cs), standby L/Cs and bank guarantees. As a general partner bank, we offer our partners extended limits in high-demand markets and additional scope for manoeuvre in selected niches. This is based on Master Risk Participation Agreements (MRPAs in accordance with the BAFT standard) which we have concluded with renowned European banks. We maintain close business relationships via their syndicate desk and are also a member of the International Trade and Forfaiting Association (ITFA).

In future, we will also take a leading role in arranging transactions for EMEA borrowers – from origination to distribution, together with experienced syndicate banks.

- Clear trade link

- Maturity periods of up to 12 months

- Single transaction checks for post-funding structures

- Risk assumption exclusively on a silent basis

- Documentation based on MRPA (BAFT standard)

- Participation only on “take-and-hold” basis

- Grantor’s retention share at least 10%

- Confirming bank offers full visibility to customers

- Decision-making time only 24 hours

- Reservations up to four weeks with no fee

- No connection necessary to the German market

- Diversified address and country limit system

- Needs-based limit extensions

- Risk appetite statement on request

Complex transactions. Precisely funded.

Exclusively at the invitation of our shareholders, we support companies and investors in challenging acquisitions. As a partner, not a competitor, we expand their scope for action in complex financing transactions.

Our services include mid-cap loans, private equity financing and corporate-to-corporate acquisitions. This results in tailor-made solutions that are precisely tailored to each project.

Our products

Experienced service provider. Modern agent.

We support our business partners with clearly defined services – reliably and professionally. As an agent, we take on the administration and coordination function in ECA-covered financings.

Our responsibilities range from managing documentation, handling disbursements and payments to coordinating communication and decision-making processes within all parties involved. Our range of services also includes the administration of Paris Club debt reschedulings.

For our shareholders, we additionally provide a B2B portal containing all relevant data. This ensures transparency, efficiency and security throughout the entire process.